2025 Federal Budget

Treasurer aims to “rebuild living standards”

Much of the 2025 Federal Budget was already known, after a volley of pre-election spruiking for votes. But Treasurer Jim Chalmers had one surprise up his sleeve – $17 billion in tax cuts. The first round of cuts will kick in on 1 July 2026 and second round on 1 July 2027, saving the average earner $536 each year when fully implemented.

With the next Federal Election due to be called any day, the Treasurer named five priorities for his fourth budget: helping with the cost of living, strengthening Medicare, building more homes, investing in education, and making the economy stronger.

He called it a plan for “a new generation of prosperity in a new world of uncertainty” that would help “finish the fight against inflation”.

The big picture

The Budget deficit has made an unwelcome, but not surprising, return. The Albanese government has been clear that we were headed back into the red and Treasurer Chalmers says the $42.1 billion deficit is less than what was forecast at both the last election and at the mid-year update.Gross debt has been reduced by $177 billion down to $940 billion, saving around $60 billion in interest over the decade.

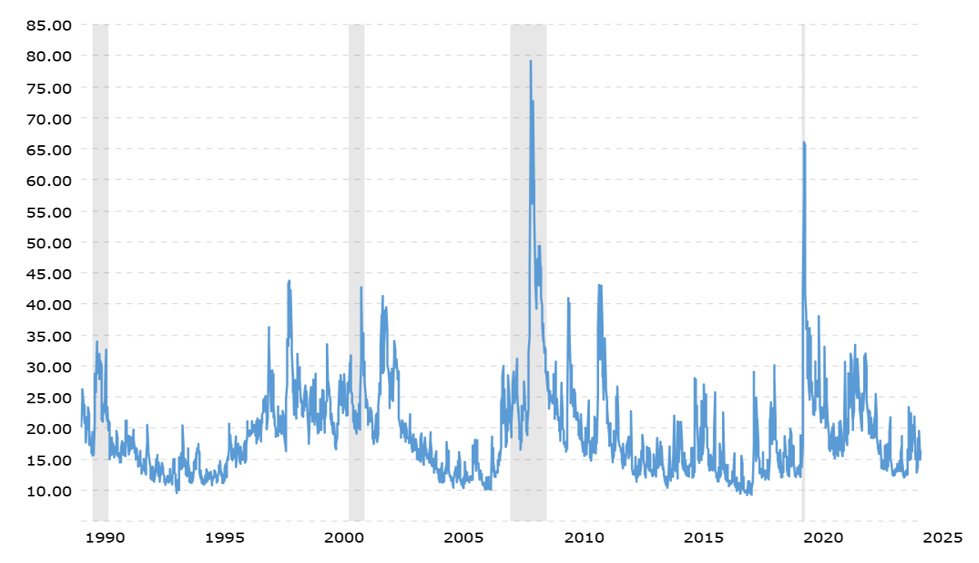

Nonetheless, Australia is navigating choppy international waters with a “volatile and unpredictable” global economy.

Australia will feel the shockwaves from escalating trade tensions, two major global conflicts – in Ukraine and the Middle East, and slowing growth in China. Treasury predicts the global economy will grow by 3.25 per cent in each of the next three years in the longest stretch of below-average growth since the early 1990s.

However, Australia is in a good position to deal with the difficult conditions, the Treasurer says.

The Australian economy has “turned a corner” and continues to outperform many advanced economies.Inflation has moderated “significantly”, and the labour market has outperformed expectations. Meanwhile growth is predicted to increase from 1.5 per cent to 2.5 per cent by 2026-27.

Addressing the cost of living

With the rising cost of living expected to be central to the upcoming election campaign, the Budget aims to deliver more support to those doing it tough with further tax cuts, changes to Medicare and the Pharmaceutical Benefits Scheme (PBS), cuts to student debt and wage increases for aged care and childcare workers among a number of initiatives

Apart from the new tax cuts due in 2026 and 2027, the government will increase the Medicare levy low-income thresholds from 1 July 2024.

The energy bill relief is also being extended to the end of this year. At a cost of $1.8 billion, every household and around one million small businesses will each receive $150 off their electricity bills in two quarterly payments.

The government claims that energy bill relief has helped to drop electricity prices by 25.2 per cent across 2024.

Students aren’t forgotten in the Budget with a cut of $19 billion in student loan debt, with all outstanding student debts reduced by 20 per cent and a promised change to make the student loan repayment system fairer.

The government is tackling the cost of living where it’s often most obvious – at the cash register. It is providing support for fresh produce suppliers to enforce their rights and will make it easier to open new supermarkets. It’s also planning to focus on “unfair and excessive” card surcharges.

Looking for a clean bill of health

Almost $8 billion will be spent to expand bulk billing, the largest single investment in Medicare since its creation 40 years ago.

Treasurer Chalmers says nine-out-of-10 GP visits should be bulk billed by the end of the decade with an extra 4,800 bulk billing practices.

There’ll also be another 50 Urgent Care Clinics across the country, taking the total to 137, and public hospitals will get a boost of $1.8 billion to help cut waiting lists, reduce waiting times in emergency rooms and manage ambulance ramping.

Cheaper medicines

The cost of medicines is also in the government’s sights. The maximum cost of drugs on the Pharmaceutical Benefits Scheme (PBS) will be lowered for everyone with a Medicare Card and no concession card. From 1 January 2026, the maximum co-payment will be lowered from $31.60 to $25.00 per script and remain at $7.70 for pensioners and concession cardholders. Four out of five PBS medicines will become cheaper for general non‑Safety Net patients, with larger savings for medicines eligible for a 60‑day prescription.

An extra $1.8 billion is also being invested to list new medicines on the PBS.

Increasing the housing stock

The government’s previously announced target of 1.2 million new homes over five years has seen 45,000 homes completed in the first quarter.

The budget sees an extra $54 million to encourage modern construction methods and $120 million to help states and territories remove red tape.

With building set to increase, more apprentices are needed, and the government has announced financial incentives of up to $10,000 to encourage more people to take up apprenticeships in building trades. Some employers may also be eligible for $5,000 incentives for hiring apprentices.

The Help to Buy program that allows homebuyers to get into the market with lower deposits and small mortgages will be expanded with an extra $800 million to lift property price and income caps to make the scheme more accessible.

To help increase housing stock available, foreign buyers will be banned from purchasing existing dwellings for two years from 1 April 2025. Land banking by foreign owners will also be outlawed.

Recovering and rebuilding

The damage from ex-Tropical Cyclone Alfred and subsequent rains in Queensland and northern New South Wales is so extensive that it is expected to wipe a quarter of a percentage point off quarterly growth.

Flooding has damaged infrastructure and disrupted supply chains, agricultural production, construction, retail, and tourism activity.

The government expects costs of at least $13.5 billion in disaster support. As a result, the Budget includes $1.2 billion to be placed in a contingency fund to better respond to future disasters.

Looking ahead

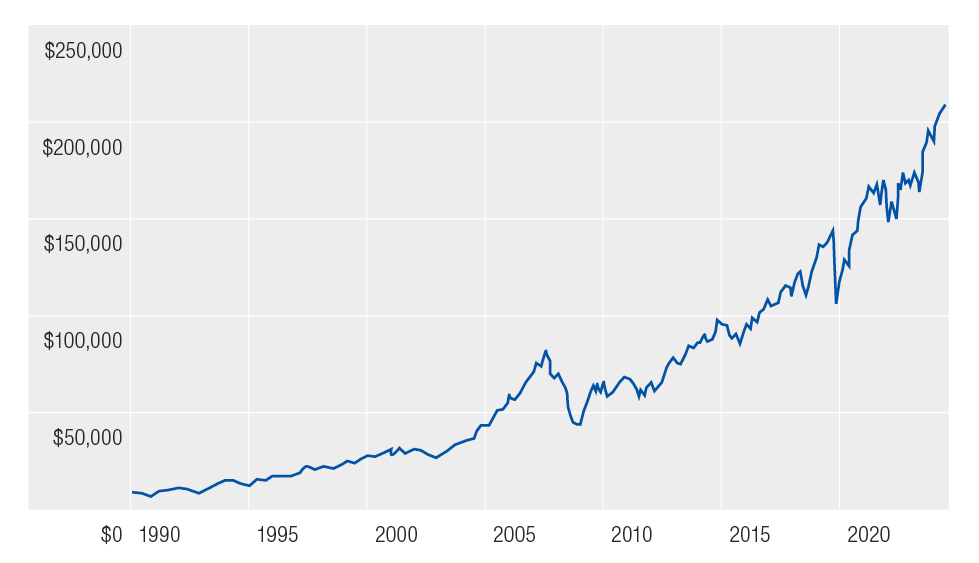

Despite concerning events on the world stage, Australia’s economy is emerging “in better shape than almost any other advanced economy”.

Inflation and unemployment are coming down and wage growth will be stronger. To help underpin continuing economic growth, the Budget adds $22.7 billion to the government’s Future Made in Australia agenda.

It includes extra investment in renewable energies and low emissions technologies and an expansion of the Clean Energy Finance Corporation. The plan also includes more than $15 billion in support for private investment in hydrogen and critical minerals production, clean energy technology manufacturing, green metals, and low carbon liquid fuels.

And, as the trade war kicks off, the Budget allocates $20 million to a Buy Australian campaign.

“The plan at the core of this Budget is about more than putting the worst behind us. It’s about seizing what’s ahead of us,” the Treasurer says.

If you have any questions about the Budget measures announced, please don’t hesitate to contact us.

Information in this article has been sourced from the Budget Speech 2025-26 and Federal Budget Support documents.

It is important to note that the policies outlined in this article are yet to be passed as legislation and therefore may be subject to change.